About Us

Karbone’s team members have over two decades of experience helping clients navigate the energy and infrastructure M&A and institutional capital markets. This includes seeking equity, debt, tax equity, mezzanine debt and preferred equity funding as well as providing financial and strategic advisory services to the power generation and energy infrastructure sectors.

The group leverages Karbone’s other business units, including the Research Group and Commodity Desks to provide unique, integrated solutions for clients.

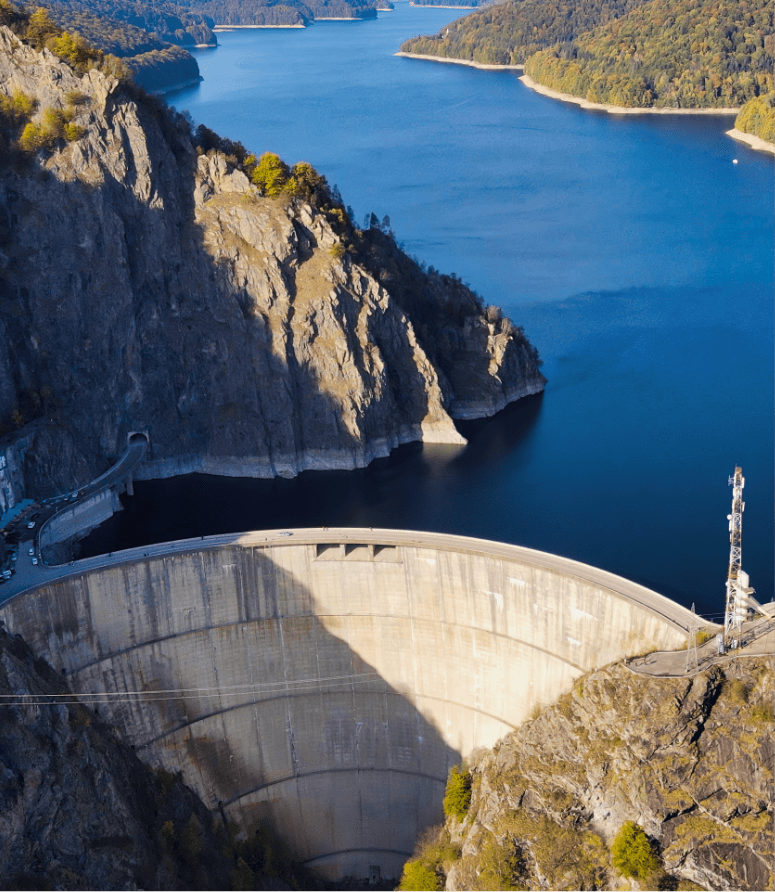

Services

Capital Sourcing

Leveraging an extensive network of developers, asset owners, and investors, Karbone is strongly positioned to efficiently advise and raise capital in the renewable energy marketplace. Our team members have successfully raised common equity, tax/structured equity, mezzanine debt, and senior debt for clients seeking growth and project capital.

M&A Advisory

Buy Side Advisory

Karbone leads with extensive acquisition experience as both an advisor and as a principal, acting on behalf of investment partners. Our Capital Markets team assists buyers from deal origination and valuation through diligence, negotiation and closing. We seek to augment our clients’ capabilities with our own unique breadth of experience and knowledge of power generation and clean-tech market transactions.

Sell Side Advisory

Karbone advises clients on corporate and asset sales. We maintain an extensive network of market participants, investors and asset owners to maximize valuation and certainty of close. Our team has run numerous sell side processes and endeavors to design a unique process that fits our clients’ needs.

Finance & Project Advisory

We provide general strategic and financial structuring advisory services to assist our clients in market evaluation, transaction preparedness, and strategic matters as they prepare to access capital or grow their business.

Access our Research platform to view daily, historical, and forward commodity pricing data

Contact Us

Have a question? Reach out to our team below.